Artificial Intelligence

The Firm of Choice for AI Innovators

Vinson & Elkins’ Artificial Intelligence practice works at the intersection of law and business, guiding clients through the many challenges of AI innovation and positioning clients to seize the opportunities in this fast-evolving domain.

Drawing on deep knowledge and experience, our seasoned lawyers advise across the full spectrum of AI development and deployment. We are the firm of choice for innovators seeking not just legal advice, but strategic, forward-thinking counsel in building, powering, scaling, and defending the next generation of artificial intelligence.

Where We Excel

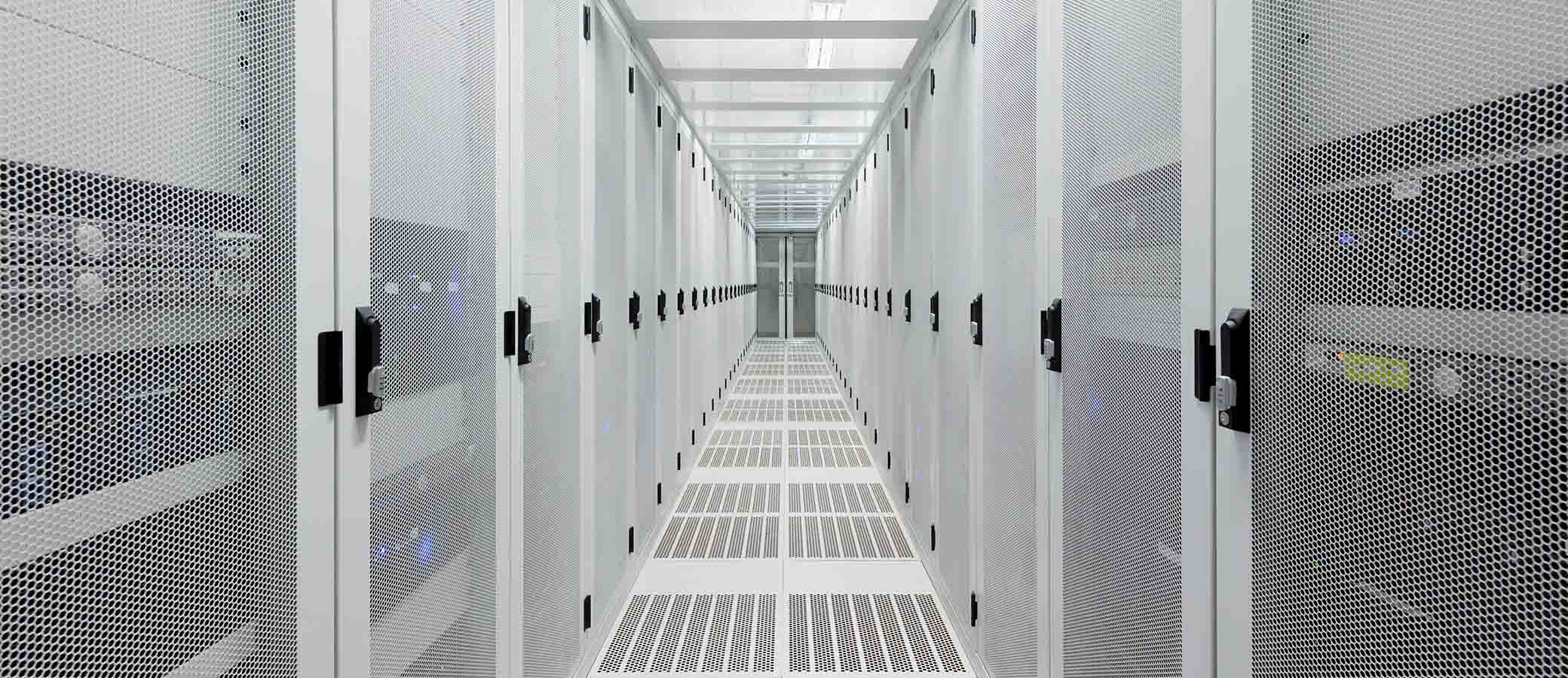

Data Centers: Development and Financing. Acquiring and developing land for AI data center construction, converting existing properties into data centers, structuring and negotiating complex transactions involving data center assets, and securing project finance.

Data Centers: Power, Operations, and Compliance. Structuring and negotiating power purchase agreements for AI data centers, developing solutions to provide reliable and cost-effective power supply, securing environmental permits, navigating regulatory compliance at the state and federal levels, and handling transmission and distribution issues, including interconnection with regional grids.

Transactions and Agreements. Providing strategic counsel on AI-related M&A, venture capital, growth equity, joint ventures, strategic alliances, and bespoke financing arrangements, licensing deals, SaaS subscriptions, and data-sharing arrangements.

Intellectual Property. Guiding clients on how best to protect, commercialize, and enforce their AI-related IP. This work includes conducting thorough due diligence, crafting and negotiate sound IP agreements, and developing robust data governance frameworks.

Governance and Risk Management. Designing and implementing thoughtful AI governance policies, ethical use frameworks, and compliance programs. This work includes helping clients mitigate the risks of inaccuracies, biases, confidentiality and data privacy concerns, and other challenges in AI systems, and incorporating the impact of AI into both voluntary and required disclosures.

Disputes and Litigation. Handling high-stakes AI-related disputes, including cases involving antitrust and unfair competition, algorithmic pricing, and data privacy. Our complex commercial litigation also advises clients involved in government investigations, bid protests, regulatory proceedings, and more.

Work with Us

With a global network of offices and strong local relationships, Vinson & Elkins delivers seamless, around-the-clock service. Chambers, Legal 500, and other leading directories recognize our lawyers for excellence in technology, energy, and infrastructure law.

Learn more below about our deep experience advising on artificial intelligence matters.

Transactional

GoPoint Ventures in a Series Seed investment in Buzz Solutions, Inc., an artificial intelligence company that provides asset fault detection and predictive analytics for powerline inspections

An international corporate venture capital fund in its investment in a leading precision medicine company developing AI tests to personalize cancer therapy

Venture capital firm in its investment in a provider of purpose-built AI agents, powered by industry-leading small language models (SLMs) for enterprise applications

An early-stage venture capital firm in its Series Seed-4 Preferred Stock Financing investment in a leading AI company that provides asset fault detection and predictive analytics for powerline inspections, providing critical savings in preventing downed lines, power outages, and sparked wildfires due to failed grid infrastructure

Venture capital firm in its investment in the Series A funding round of a next-generation cloud resource optimization and management platform that uses cutting-edge distributed container infrastructure as well as Artificial Intelligence and Machine Learning to help enterprises reduce spending in the cloud by up to 80%, while enhancing both operational security and performance

An international corporate venture capital fund in its investment in a company that develops wired and wireless NaaS (network-as-a-service) solutions

Goldman Sachs in its lead investment in the $32 million Series A preferred stock financing of Entera, developer of a real estate technology platform intended to support data-driven decisions and purchases related to residential real estate

Venture capital firm in its investment in the Series B funding round of a platform that revolutionizes how enterprises automate business operations by transforming simple instructions into self-maintaining AI agents

Venture capital firm in its investment in a company that is creating a generative AI solution for complex cloud-native environments to automate IT troubleshooting for enterprises

Goldman Sachs in its lead investment in the $175 million preferred stock financing round of Bloomreach, a provider of commerce experience cloud products

Goldman Sachs in its lead investment in the $45 million Series B preferred stock financing round of RippleMatch, a recruitment automation platform

Prosperity7 Ventures in its lead investment in the $25 million financing round of Rain Neuromorphics, a developer of brain-inspired hardware for artificial intelligence

Quantum Energy Partners in an investment in the Series A preferred stock financing of Orennia, a developer of technology solutions for renewable energy investment and allocation decisions

Venture capital fund in its investment in the Series A funding round in a cutting-edge cloud platform that leverages the next generation of AMD accelerators to provide scalable, memory-optimized infrastructure for the most demanding AI workloads

A portfolio company of Vista Equity Partners substantially acquired all of the assets of Update Technologies, Inc.

Pensa Systems, a provider of autonomous perception systems for inventory visibility, in its Series Seed Preferred Stock financing led by Signia Venture Partners and ATX Venture Partners

Venture capital fund in its investment in the Series A funding round of an artificial intelligence company that bridges the gap between AI product development and deployment for enterprises

Atlas Energy Solutions Inc., a leading proppant producer and proppant logistics provider, in its agreement with Kodiak Robotics, Inc., a leader in autonomous ground transportation, whereby Kodiak will deploy bespoke autonomous driving technology in Atlas’ high-capacity trucks

In re MultiPlan Health Insurance Provider Litig., MDL No. 3121 (N.D. Ill.) – Representing numerous large hospital systems as plaintiffs in connection with claims that MultiPlan orchestrated a nationwide conspiracy among healthcare payors—including all of the largest payors in the country—to use algorithmic software to artificially suppress reimbursements paid to healthcare providers for out-of-network healthcare services

In re RealPage Software Antitrust Litigation, MDL No. 3071 (M.D. Tenn.) – Representing four of the largest property management companies in the United States in connection with allegations that apartment rental companies used algorithms provided by RealPage to conspire with one another to prop up rent prices for multifamily housing throughout the United States

In re Yardi Revenue Management Antitrust Litig. (W.D. Wash.) – Representing multiple property management companies in connection with consolidated class actions alleging use of a common third-party revenue management algorithm inflated rental prices across the United States

Advised major technology company on antitrust considerations related to AI safety/security collaborations and Cloud-related issues

Defended leading technology company in various global antitrust investigations relating to its AI-powered services

Represented Alphabet-owned Intrinsic in its 2022 acquisition of AI/robotic intelligence firm Vicarious

Developed form customer license agreements for the company, a developer of industry-specific augmented intelligence software

Commercialization and licensing program with respect to a web platform that provides user credential authentication for media networks

Developing form customer agreements, terms of use, partnership and distributor agreements, and policies for multiple companies

Counseling client regarding data ownership and usage related to driver data (including patterns and algorithms) gathered while operating toll projects; patent prosecution for anomaly detection machine learning tool

Advised real estate company in the development and implementation of its digital loyalty program, including negotiating agreements with technology developers and counseling our client on data privacy and use restrictions

Counseling media company regarding open source software matters, including licenses for contribution of code to open source community

Counseling pharmaceutical company related to open source software and cybersecurity matters in connection with its acquisition of provider of cloud-based solutions for chronic respiratory disease management

IFM Investors in the formation of a joint venture with DigitalBridge to acquire Switch, Inc. in a $11 billion take-private transaction

DigitalBridge on its joint venture with Brookfield Infrastructure for the purpose of acquiring a 51% ownership stake in GD Towers, Germany’s largest tower company, valuing the company at €17.5 billion

Swiss Life Asset Management and EDF Invest in the $1.2 billion acquisition of a 27% interest in DataBank, the largest edge infrastructure operator in the U.S.

Talen Energy Corporation (NASDAQ: TLN) on its 1,920 MW power purchase agreement and associated arrangements with Amazon Web Services to provide carbon-free energy from Talen’s Susquehanna nuclear power plant to support AMZN’s announced $20 plus billion dollar data center build out in Pennsylvania

Blackstone in the acquisition of Sabre Industries, a leading manufacturer of data center power products, towers, battery storage and related solutions for electrical utility and telecom end markets, from The Jordan Company

Goldman Sachs in a strategic, preferred equity investment in Elea Digital, a connected platform of edge data centers across Brazil

DigitalBridge in its acquisition of a controlling stake in Vertical Bridge Holdings, the largest private owner and operator of wireless communications infrastructure in the U.S.

Aligned Data Centers and its sponsor Macquarie Asset Management in its acquisition of ODATA, a data center service provider of scalable, reliable and flexible IT infrastructure in Latin America

Live Oak Acquisition Corp. II, a SPAC, in its $1.4 billion business combination with Navitas Semiconductor, the industry leader in Gallium nitride power ICs

Sale of edge data center facilities powered by renewable energy in Iceland to Vauban Infrastructure Partners

ARCOS, a Vista Equity Partners portfolio company and leader in cloud-based technology for utilities, in its acquisition of Treverity, a software solutions provider for U.S. electricity and natural gas distribution utilities

Related People

Related Insights

- Insight

V&E Artificial Intelligence Update

July 28, 2025 - Insight

V&E Governance & Sustainability Update

June 9, 2025 - Event RecapMarch 27, 2025Video

- Insight

V&E Technology Update

February 7, 2025